It’s pretty obvious that some wealthy people earn a lot of money. What isn’t obvious is that you can become financially independent or even wealthy with a modest income. Step one of my financial strategy was don’t overspend. Mastering that first step requires that you train yourself to keep your money with good spending habits. That makes it possible to implement step two, save as much as possible. The fastest way to accrue wealth is to invest in your own earning potential early, and to set as high a savings rate as possible.

Investing Early In Your Earning Potential

A large income early in your life allows you to have large savings over a long period of time. Get a good education early, and use it to increase your income level. Statistics Canada’s 2006 census data on education shows that a university education roughly doubles the average income. Averages can be misleading of course. Certain degrees will affect your income level more than others, but in general, educated people have a higher earning potential, and work higher paying jobs.

Employers have problems to solve in order to achieve their goals. Some problems are low skill, and mostly a matter of manpower. Factory and service industry jobs are good examples of manpower driven industries. Typically, these jobs require few specialized skills, and involve physical limitations to how productive a single employee can be. A single person can only carry so many dishes, or operate one machine at a time. The more buttons you push, or customers you serve, the more the employer profits from your labour. Because of the low skill involved, the pool of potential employees is large and the wage is low. If you’re reluctant to take that job for a low wage, the employer can find someone else who’s willing rather easily.

Other industries require specialized knowledge to even begin working on certain problems. These tend to be higher paid professions: engineering, medicine, law and so on… Employers have difficulty finding good people capable of doing these jobs. You might be able to pull the average person of the street into a café, and they can do a decent job handing bagels to customers. Try doing the same thing to replace a control systems designer, a surgeon, or federal prosecutor, and things will quickly begin exploding. If you can train yourself to be a skilled problem solver in a profession, you earn the ability to demand a higher salary for solving problems that others are unable or unwilling to tackle. It gives you the confidence and skill to resolve problems that intimidate or confuse others.

Financial Discipline: 50% Savings Rate

Most people do not set a sufficiently high savings rate to accrue real wealth. According to Statistics Canada, the median total family income in 2011 was $72,240. Median is the midpoint, meaning half of Canadian families make more annually, and half make less. 2005 figures indicate that 42% of Canadian family units (single people or groups of cohabiting relatives) have a net worth below $100,000. Only 8.2% of Canadian families have a net worth above $1,000,000 while an astounding 6.5% of our families have a negative net worth! A homeless beggar may be flat broke, but he has no debt; thus, his net worth isn’t negative. How are 6.5% of Canadians doing worse than living on the street without a job?!

Net worth is the total value of all assets you own minus your debts: your house, car, cash, investments, and all your stuff that could be legally sold, minus your loans, credit card balances, and mortgage. If the median family income is over $70,000 then most Canadian families should be millionaires. Only about 8% actually are because most people are really good at not saving.

These figures are consistent with the common advice you hear about saving for retirement – save 10% of your salary. Some employers offer a salary match, where they will essentially give you extra money as an incentive to regularly contribute some of your salary to a retirement savings plan (RSP). A family that makes the median salary, and saves only the suggested 10% will contribute about $7000 to savings every year. It takes over 14 years to assemble $100k from annual contributions of only $7k. This explains why 42% of families have a net worth below $100,000.

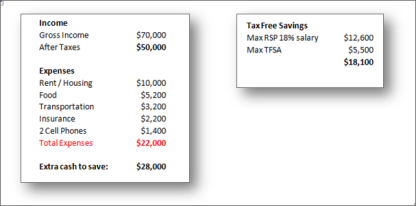

When aiming for financial independence, set your savings rate as high as possible. There are good opportunities in Canada to grow your savings tax-free using RSPs and TFSAs. As a bare minimum, if you are a normal working adult, you should be contributing the annual maximum to your tax free accounts (RSP and TFSA) which represents about 25% of the median salary. Personally, I aim for a 50% savings rate. This is not magic, but financial discipline. A realistic sample budget of how this can be done shows that the median Canadian family should have close to $30,000 annually for non-essential expenses and savings. How do most Canadian families fail to put away tens of thousands of dollars per year?

Preparing to Invest

You have learned to control your spending, improved your education, found yourself an acceptable employer, maybe even an acceptable hipster spouse who wanted to marry rich before you were cool. You’ve adopted a 50% savings rate and started building your wealth. You are now literally sitting on a pile of money, with gold coins jammed uncomfortably into your butt. What are you going to do with all of this money? Don’t rush. Everyone has ideas of how you should spend it or invest it. You feel like a target because you are. Not being stupid is much harder than it seems. Now it’s time to start reading about investing. If you are afraid of math, conquer your fear and start learning some basic financial math. Relax, it’s almost entirely arithmetic. I will recommend some books, and for the people as lazy as I am, I will simply summarize all of the stuff I’ve read into my personal investing strategy in a future post.

Before your months investing research consolidates into a mental fortress of investment skill, I would suggest following a safe strategy – avoid buying investments you don’t understand. If you know what you’re buying, it is difficult for someone else to rip you off. Oh, and welcome to the big leagues. You’re 80% of the way to financial independence!